Consumers Push Back on Auto-Refill Unless It's Simple and Flexible

35:00

Bean Box CEO Matthew Berk and HomeLife Chief Technology Officer Ivan Rodriguez tell Karen Webster that tailored, personalized, simplified and flexible subscriptions can turn customers into lifelong fans who find the goods and services essential.

Related Videos

In Tough Questions

-

Play video Are Real-Time Payments Near an Inflection Point? Bank of America Thinks So

Are Real-Time Payments Near an Inflection Point? Bank of America Thinks So

Margaret Weichert, chief product officer at The Clearing House, and Irfan Ahmad, managing director and head of U.S. Payments, GTS, at Bank of America, tell PYMNTS that B2B and consumer-focused payments are ripe for a transformation as real-time payme

30:27

-

Play video Point-of-Care Payment Options Expand Access to Dental Care for Patients

Point-of-Care Payment Options Expand Access to Dental Care for Patients

Dr. Steven Rasner, DMD, MAGD, of Pearl Smiles, and Ed O'Donnell, CEO of Versatile Credit, tell Karen Webster that offering financing options at the point of care can keep patients from biting off more than they can chew when it comes to holistic, fee

34:59

-

Play video Panel: The Future of B2B Commerce is Balancing Innovation With Risk Management

Panel: The Future of B2B Commerce is Balancing Innovation With Risk Management

FinTech innovation and partnerships with traditional institutions is helping to move more business payments digital. Tribh Grewal, head of FinTech partnerships at Discover Global Network, and Jonathan Vaux, head of propositions and partnerships at Th

20:00

-

Play video Virtual Cards Set to Transform Buyer-Supplier Relationships

Virtual Cards Set to Transform Buyer-Supplier Relationships

Virtual cards are reaching a tipping point as both B2B buyers and suppliers turn to them as a key a source of payments certainty. That's according to a recent PYMNTS panel discussion of industry heavyweights that featured Robin Boudsocq, head of comm

30:41

-

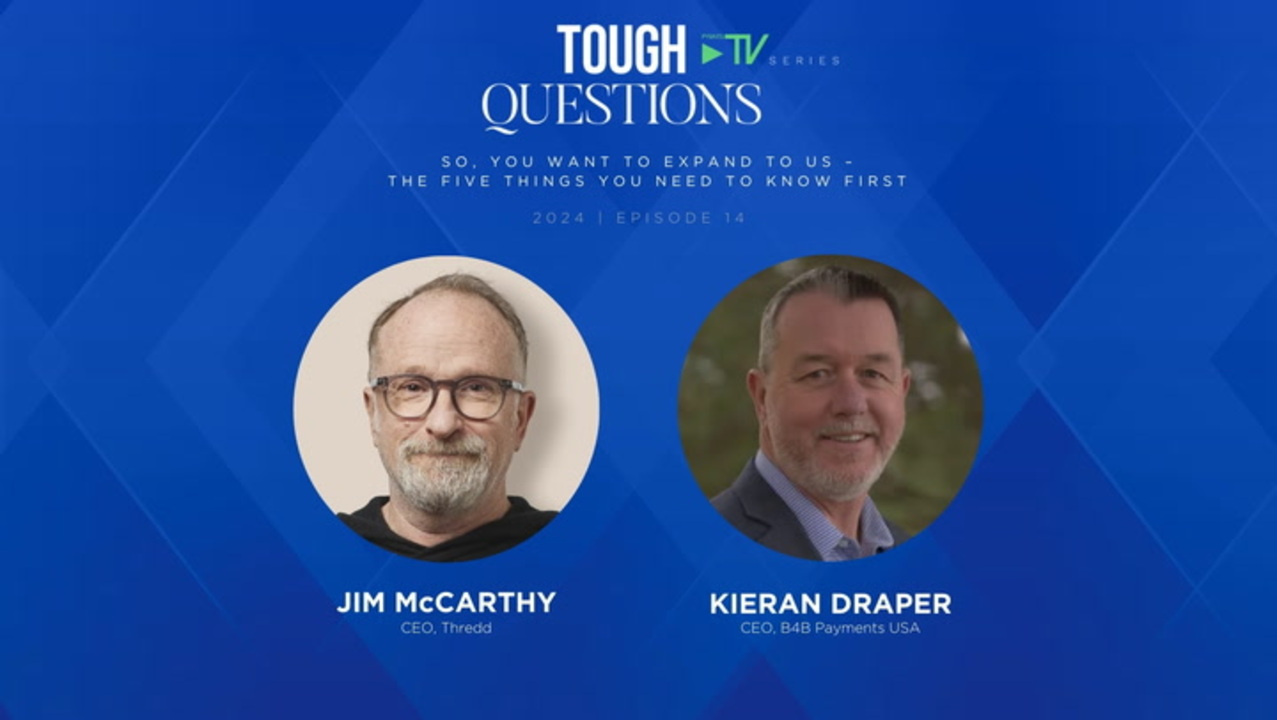

Play video FinTechs Looking to Enter the US Market Better Be Sponsor-Bank Ready, Says Thredd's McCarthy

FinTechs Looking to Enter the US Market Better Be Sponsor-Bank Ready, Says Thredd's McCarthy

Take it from two executives who have done it. Thredd CEO Jim McCarthy and B4B Payments CEO USA Kieran Draper have both led their companies to U.S. market entry and they give PYMNTS' Karen Webster the benefit of their experience. Their insights cover

40:00

-

Play video Banking-as-a-Service Focus Turns to Managing Financial Crime Risks

Banking-as-a-Service Focus Turns to Managing Financial Crime Risks

With the Synapse disruption looking more contained, the focus now turns to managing third-party relationships. Alena Robertson, BaaS manager at Grasshopper Bank, and Chris Caruana, vice president of strategy at Hawk, explored managing the risks and r

20:00